Trading profitably in financial markets often requires a deep understanding of price action and technical analysis. Harmonic patterns, unique graphical formations derived from Fibonacci ratios, have emerged as a valuable tool for traders seeking to predict potential trend reversals or continuations. By recognizing these patterns, traders can gain insights into underlying market dynamics and make strategic trading decisions.

- Harmonic patterns are based on the principle that price movements often retrace in specific ratios, indicating potential areas of support and resistance.

- Employing harmonic pattern recognition can help traders validate existing trading ideas or identify new opportunities.

While no trading strategy is risk-free, understanding and applying harmonic patterns can substantially enhance a trader's analytical abilities and potentially unlock greater profit potential.

Mastering Technical Analysis for Optimal Trading Decisions

In the dynamic realm of financial markets, where fortunes are earned and lost in a heartbeat, technical analysis stands as an invaluable tool for savvy traders. By meticulously studying past price movements and identifying recurring patterns, traders can gain crucial understandings into potential future trends. A deep understanding of technical analysis principles empowers traders to make more strategic decisions, reducing risk while maximizing their chances of success. Mastering chart patterns, indicators, and other analytical methods is essential for navigating the complexities of the market and securing profitable outcomes.

Algorithmic Trading Strategies: A Guide to Success

In the dynamic realm of finance, automated trading strategies are rapidly gaining traction. These sophisticated get more info systems leverage cutting-edge algorithms to execute trades with accuracy and velocity. By processing vast amounts of market data in real time, automated trading strategies aim to identify profitable opportunities and minimize risk.

- Financial Professionals can capitalize from automated trading by allocating their resources more effectively. By mechanizing the trading process, these systems free up valuable time for traders to focus on strategy development.

- Furthermore, automated trading strategies can improve decision-making by mitigating emotional bias, which can often impede trading performance. By adhering to pre-defined rules and parameters, these systems can execute trades consistently.

Nevertheless, it's essential for traders to understand the complexities of automated trading. Thorough research, backtesting, and prudent planning are vital for success in this evolving market landscape.

Decoding Market Trends: An In-Depth Look at Harmonics Patterns

Harmonics formations within financial markets can reveal intriguing insights into price movements. By analyzing these repeating designs, traders aim to anticipate future directions. These formations often emerge as adjustments within a broader trend, offering potential exit scenarios. Mastering the skill of harmonics requires dedication and an thorough grasp of market behavior.

- The most common harmonics pattern is the golden ratio, known for its accurate signals.

- Interpreting these patterns can boost your trading approach.

- A comprehensive assessment of harmonics should include other technical measures for a more holistic view.

Crafting a Robust Trading Strategy: Combining Technical Analysis and Automation

Developing a successful trading strategy demands a blend of quantitative skills and the right tools. Technical analysis, the study of price trends and patterns, provides invaluable insights into market dynamics. By leveraging technical indicators and charting methods, traders can identify potential entry and exit points, reducing risk and enhancing returns. , Additionally , automation plays a essential role in executing trades with precision and agility, freeing up traders to focus on strategy improvement. A robust trading strategy seamlessly merges these two pillars, empowering traders to navigate the volatile markets with confidence.

The Power of Automated Harmonics Detection in Trading Systems

In the dynamic world of algorithmic trading, identifying profitable market trends is paramount. Sophisticated harmonics detection has emerged as a powerful tool, empowering traders to uncover hidden patterns and capitalize on market fluctuations. By leveraging advanced algorithms that analyze price data and identify recurring formations known as harmonics, these systems can generate actionable signals with increased accuracy. This enables traders to make informed decisions, maximize their trading strategies, and potentially achieve superior returns.

Luke Perry Then & Now!

Luke Perry Then & Now! Scott Baio Then & Now!

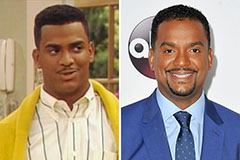

Scott Baio Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!